The crisis of retail

The crisis of retail is not an entirely new phenomenon but it is clearly getting worse. In the US, many shopping malls have recently closed down. Not only are internet giants disrupting retail as we knew it and threatening its traditional models…but larger cultural changes are also reshaping consumer expectations, leading consumers to increasingly :

- value experience over ownership;

- convenience over wide choice;

- sustainability over low prices,

- personalisation over standardisation.

Does shopping still have a future? What if shoppers became makers?

Shopping malls were the preferred distribution channels of the empowered middle classes of the 20th century. They were the product of the Fordist mass-production economy.

But these temples of consumption that consumers visited on a weekly basis are now on the decline. Shopping rituals and habits are changing fast.

As retailers are trying to reinvent the shopping experience, many new models are set to replace the traditional ones. One in particular will be explored in this article: will shoppers be turned into makers?

Why traditional retail is dying a slow death

Several iconic US retailers have recently made the headlines for going through a rough patch. Sears is one example. Walmart is another: its not-so-subtle ‘Copy Amazon’ strategy further reveals it is slowly becoming irrelevant.

Even newer concepts like Whole Foods are now struggling.

In Europe too, large hypermarkets located at the periphery of urban centres are losing ground. Traditional retailers like Tesco, Sainsbury’s or Carrefour are trying to adjust their offer by multiplying the number of smaller convenient stores in the city centres, but they are burdened with less profitable stores they don’t really know what to do with.

Non-grocery retailers seem to be hit the hardest. In the US, Macy’s announced it is closing 100 stores. Similar announcement were also made by Sears, Gap, and Abercrombie & Fitch. The decline in foot traffic in shopping malls has been dramatic and spectacularly fast: according to the real-estate research firm Cushion and Wakefield, there were 35 million visits to US shopping malls in 2010 and only 17 million in 2013, which amounts to a spectacular 50% fall within 3 years.

As many as 15% of all shopping malls in the US are expected to close down within the next three to four years.

In fact, no matter how well they respond to changing expectations, the crisis of retail seems unstoppable for numerous reasons:

E-commerce and the rise of digital retail giants Amazon and Alibaba

Internet has brought about new business models that transform ownership into services

Macroeconomic trends are also to blame

The post-war boom years were fuelled by the rising purchasing power of a large empowered middle class who could consume more and more. By contrast, today’s middle classes have seen their purchasing power stagnate or decline over the last three decades. Higher income inequalities are not a good thing for retail because the super rich have a lower propensity to consume.

Retail needs the middle classes to be richer because they have a higher propensity to consume. (A household that has a €20,000 annual revenue will spend it all. For that household, an extra €5,000 would also be spent, whereas an extra €5,000 added to a €150,000 annual revenue would be saved, not spent. That’s what’s known as the ‘propensity to consume’). Discount retail has therefore flourished in the past 30 years but the overall value of retail has not;

A shift in spending patterns is due to the densification of large urban centres

Storing food is increasingly costly: it requires space, equipment, and a car, which fewer people have in expensive cities.

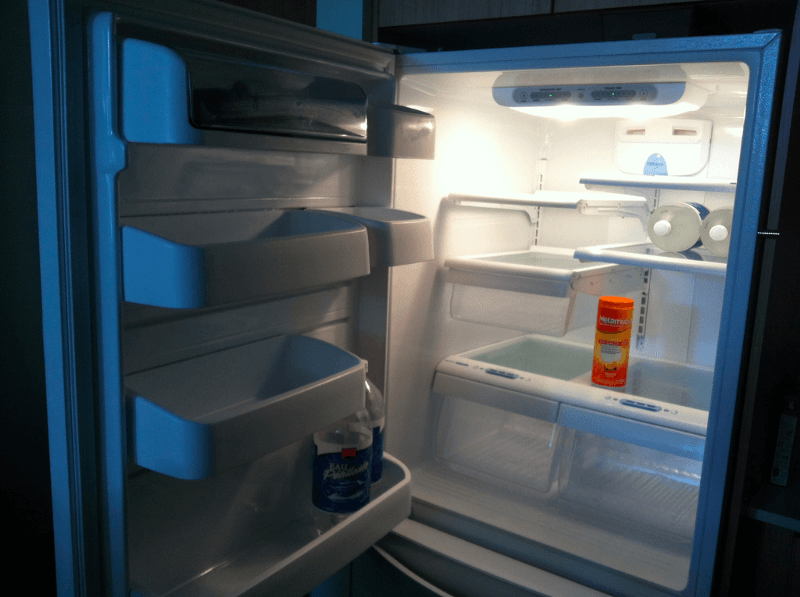

Indeed more urban populations tend to spend more on housing in denser cities, they rarely have a car and they have less room to store large amounts of food. The proportion of consumers with cars and multiple fridges has gone down.

Furthermore, the more urban the population, the smaller the average household: there’s no need to store lots of food anymore. Singles can go for fresh food every day and have empty fridges. (Also the urge to store food tends to wane as the last generations that experienced hunger and rationing during the war are progressively dying out).

Shopping doesn’t generate status anymore

A lot of the products that provided status in the 1960s (a car, a TV set…) are now cheaper or just not built to last. In our throw-away culture, owning things doesn’t come with status. Throw-away items merely provide a quick fix. There is no need to buy more stuff to keep up with the Joneses. That’s not where you place your pride anymore.

Shopping has just become boring

The standardised mass-consumption experience of retail stands in sharp contrast with the personalised experience users have online. Algorithms help create an environment designed to cater to the specific needs and tastes of each user whereas supermarkets cater to masses of undistinguishable customers. Shopping is all the more perceived as boring as more and more fun activities are to be experienced online.

In some ways, Instagram and Facebook time have replaced the weekly trip to the shopping mall. Increasingly few teenagers now choose to hang out with friends at the mall. Shopping is also less frequently listed as a “hobby” today.

Consumers suffer from choice fatigue

Overly stimulated by an overload of information about products and brands, consumers seek environments where less is more.

People are more likely to not make a decision if they suffer from choice fatigue, i.e. not buy anything.

Offering too many choices as supermarkets do actually reduces sales. In our highly saturated retail markets choice fatigue is as much a societal phenomenon as an individual one.

What will traditional retail stores be replaced with?

Several trends have already transformed our modern retail landscape and retail’s relationship to space: the success of discounters, the rise of smaller proximity convenience stores, online retail, data-driven omni-channel shopping offers, the opening of pure player brick-and-mortar stores, the increasing number of exclusive brand stores and concepts…

There are basically two ways shopping can be reshaped to fit new consumer expectations: it can either be made more painless and seamless — that’s what accounts for the rise of convenience stores and the concept behind Amazon Go — , or shopping can be made about the experience rather than the products. The second path is a vast terra incognita that retailers, real-estate companies and a wide range of business people are now trying to explore. What does it mean to make it about the experience? There are many possible answers to that question.

One of the possibilities that is now often put forward by experts and already giving rise to many business promises is the idea of providing customers with the opportunity to make, prepare, grow, or build their own things. Sometimes the business, governance and organisation models that come with it are a radical alternative to traditional business ownership: for example, the ‘commons’ could make a comeback. The commons is the cultural, infrastructural and natural resources accessible to all members of a society that are held in common, not owned privately. When owned collectively by a group of workers, it becomes a cooperative…

The success of collaborative spaces — coworking spaces, makerspaces, fab labs, hackerspaces — that have spread fast in urban centres (and sometimes also in more rural areas), testifies to the idea that modern-day commons are indeed being (re)invented. The popular makers movement is further evidence that the Do It Yourself trend continues to spread across the globe. That’s why so many DIY workshops and cooking classes are being offered in lieu of traditional retail. In France, Leroy Merlin, a home improvement and gardening retailer has been leveraging the DIY trend like no other retailer, offering numerous workshops, exchange forums, makerspaces, etc. and even establishing itself as a reference in that area.

Of course the idea of commons typically include so-called fab labs, giving everyone the use of 3D printers and other high tech equipment like virtual reality gear and such things. But what if low tech also became a trend? What if many consumers were also hungry for more traditional old-fashioned ways?

In the late 19th century, Britain was already heavily industrialised. A movement of “makers” and philosophers emerged to criticise industrialisation and offer an alternative to the standardised products British factories were producing by the thousands. Britain’s Arts and Crafts movement was both an artistic and a political movement, which flourished in Europe and North America between 1880 and 1910.